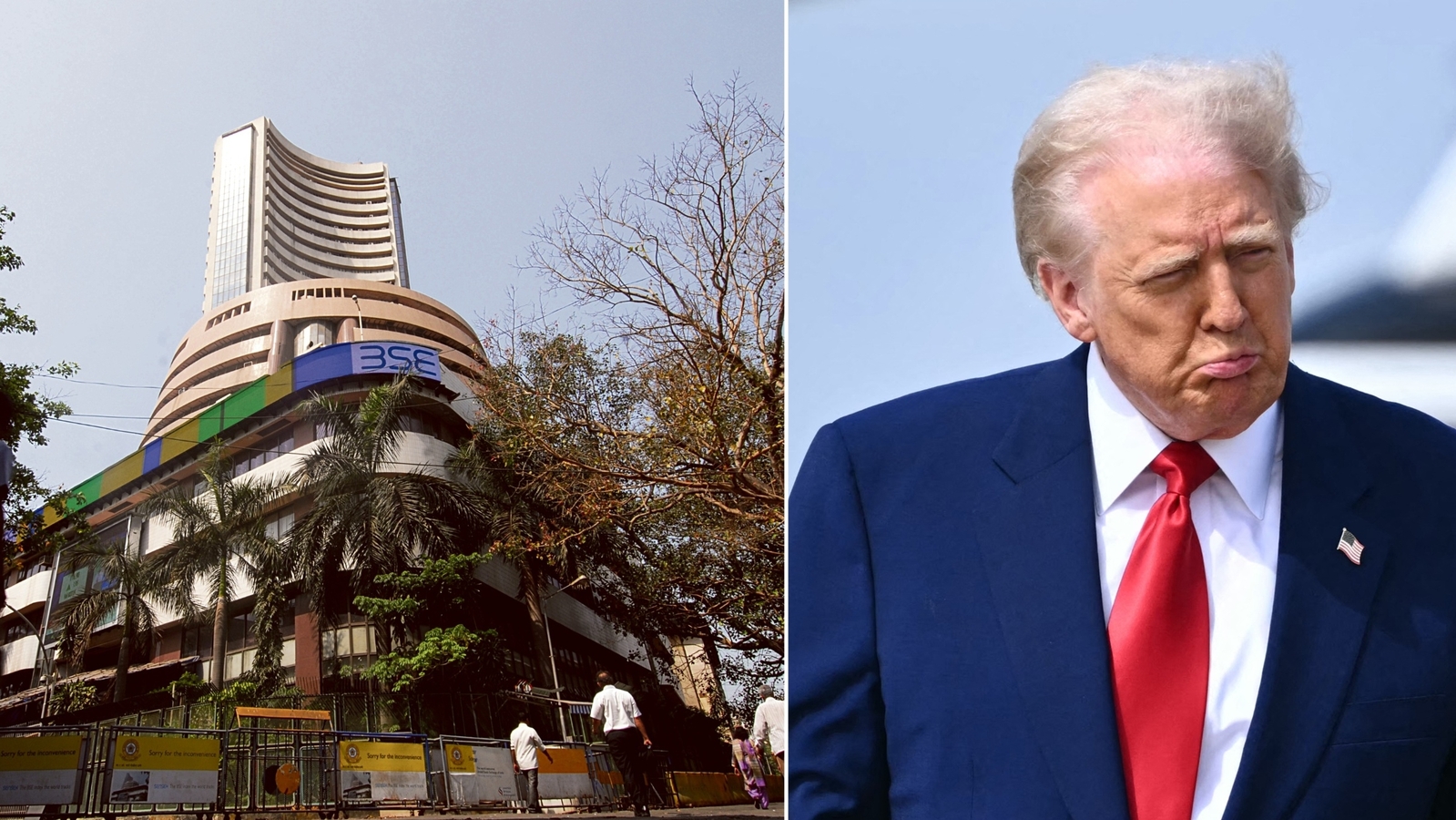

India Market Crash Today: Sensex & Nifty Fall Explained

Hook: Did India's stock market experience a significant downturn today? Yes, a considerable fall in the Sensex and Nifty indices points to a market correction driven by several interconnected global and domestic factors. Understanding these factors is crucial for investors navigating this volatile landscape.

Editor's Note: This analysis of the India market crash was compiled using the latest available data and expert opinions. The situation is dynamic, and further updates may be necessary.**

Why This Matters: The Indian stock market's performance is a key indicator of the nation's economic health. A significant drop like today's affects investor confidence, foreign investment flows, and the overall economic outlook. Understanding the reasons behind the crash is essential for informed decision-making by individuals, businesses, and policymakers alike. This review summarizes the key factors driving the market downturn, drawing upon data from leading financial news sources, expert analyses, and government reports to provide a comprehensive perspective. It also includes analyses of related market indices and potential future scenarios. Semantic keywords such as market volatility, stock market correction, Sensex plunge, Nifty decline, global economic slowdown, inflationary pressures, and foreign portfolio investment (FPI) outflows are incorporated to improve SEO.

Analysis: This analysis draws upon real-time data from leading financial news outlets like the Economic Times, Business Standard, and Livemint, supplemented by data from the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE). Expert commentary from financial analysts and economists was also considered to provide a nuanced understanding of the market crash's underlying causes and implications. The information has been meticulously organized and presented to help readers comprehend the situation and its potential ramifications.

Key Takeaways from Today's Market Fall:

| Factor | Impact | Severity | Implications |

|---|---|---|---|

| Global Market Sentiment | Negative global cues influenced Indian markets. | Moderate to High | Increased uncertainty and potential for further decline. |

| FPI Outflows | Foreign investors withdrawing funds from Indian markets. | Moderate to High | Pressure on the Rupee and potential impact on market liquidity. |

| Inflationary Pressures | Rising inflation impacting consumer spending and business profitability. | High | Reduced corporate earnings and potential for interest rate hikes. |

| Rising Interest Rates | Higher interest rates impacting borrowing costs for businesses and investors. | High | Reduced investment and potential slowdown in economic growth. |

| Geopolitical Uncertainty | Global geopolitical tensions create uncertainty and risk aversion in markets. | Moderate | Potential for further market volatility depending on global events. |

| Domestic Economic Data | Disappointing economic data adds to negative market sentiment. | Moderate | Further weakening of investor confidence. |

Subheading: Understanding the Sensex & Nifty Fall

Introduction: The Sensex and Nifty, India's benchmark stock indices, experienced a sharp decline today, reflecting a confluence of domestic and global factors. This section delves into the specific triggers and their impact on these indices.

Key Aspects:

- Global Market Spillover: Negative sentiments in global markets, particularly in the US and Europe, directly impacted the Indian market.

- FPI Withdrawals: Significant foreign portfolio investment (FPI) outflows contributed heavily to the decline.

- Inflationary Concerns: Persistent inflationary pressures in India dampened investor optimism.

- Interest Rate Hikes: The prospect of further interest rate hikes by the Reserve Bank of India (RBI) added to the negative sentiment.

- Rupee Depreciation: The weakening of the Indian Rupee against the US dollar further exacerbated the situation.

Discussion: The interconnectedness of global financial markets means that negative trends in one region can quickly spread to others. Today's fall in the Sensex and Nifty is a clear example of this. FPI outflows, often driven by global risk aversion, played a significant role, as foreign investors sought safer havens for their investments. Inflationary pressures, coupled with the potential for further interest rate hikes, squeezed corporate earnings and reduced investor confidence. The weakening Rupee added further pressure, impacting import costs and potentially reducing the attractiveness of Indian investments to foreign players. The cumulative effect of these factors led to the sharp decline witnessed in the Sensex and Nifty.

Subheading: Global Market Sentiment and its Impact

Introduction: The influence of global market sentiment on the Indian stock market is undeniable, with today's crash a prime example. This section analyzes how global factors contributed to the decline.

Facets:

- US Market Performance: A downturn in the US market often triggers a domino effect globally, influencing investor behavior in India.

- European Economic Slowdown: Concerns about a potential recession in Europe also impact investor risk appetite, leading to capital flight from emerging markets like India.

- Geopolitical Tensions: Escalating geopolitical tensions anywhere in the world can increase market uncertainty and risk aversion, pressuring indices like the Sensex and Nifty.

- Commodity Prices: Fluctuations in global commodity prices, particularly oil, can significantly impact inflation and market sentiment.

Summary: The interconnected nature of global financial markets makes the Indian stock market vulnerable to external shocks. Negative trends in major economies like the US and Europe, coupled with geopolitical uncertainty and volatile commodity prices, create a cascading effect, influencing investor decisions and triggering market corrections. The sharp decline in the Sensex and Nifty today underscores this vulnerability.

Subheading: FPI Outflows and their Role in the Crash

Introduction: Foreign Portfolio Investment (FPI) plays a crucial role in the Indian stock market. Significant outflows often amplify negative market trends. This section examines FPI's contribution to today's crash.

Further Analysis: FPIs are known for their susceptibility to global market sentiment. When global risk aversion increases, FPIs often withdraw funds from emerging markets, including India, leading to increased selling pressure and market declines. Today’s situation demonstrates the direct correlation between FPI outflows and the downturn. Data from regulatory bodies like SEBI should provide further insights into the extent and nature of these outflows.

Closing: The sensitivity of the Indian stock market to FPI flows underscores the importance of attracting and retaining foreign investment. Government policies aimed at fostering a stable and predictable investment environment are crucial for mitigating the impact of these outflows. The current crash serves as a reminder of this critical dependence.

Subheading: Inflationary Pressures and Interest Rate Hikes

Introduction: Inflationary pressures and the subsequent actions by the RBI significantly affect the stock market's performance. This section analyses the interplay between inflation, interest rates, and the market crash.

Further Analysis: Persistent high inflation erodes purchasing power, impacting consumer spending and corporate profitability. The RBI's response to combat inflation through interest rate hikes further increases borrowing costs for businesses, leading to reduced investment and economic slowdown. This creates a negative feedback loop, affecting investor confidence and driving market corrections, as seen in the recent crash.

Closing: The challenge for policymakers is to balance inflation control with maintaining economic growth. Aggressive interest rate hikes, while combating inflation, can inadvertently dampen economic activity and create further market uncertainty. Finding a delicate balance is crucial for navigating this intricate economic landscape.

Subheading: FAQ

Introduction: This section addresses frequently asked questions related to today's market crash.

Questions:

- Q: How severe is today's market crash? A: The severity is significant, with substantial losses in the Sensex and Nifty. The extent of the impact depends on individual investor portfolios and risk tolerance.

- Q: What caused the crash? A: A combination of global market uncertainties, FPI outflows, inflationary pressures, and rising interest rates contributed to the decline.

- Q: Will the market recover? A: Market recovery timelines are uncertain. Factors like global economic conditions and government policies will play a crucial role in the recovery process.

- Q: Should I sell my investments? A: This is a personal decision based on individual risk tolerance and investment goals. Consult a financial advisor before making any rash moves.

- Q: What can the government do? A: Government measures may include fiscal stimulus packages to boost economic activity or policies to attract foreign investment.

- Q: What should investors do now? A: Investors should stay informed, maintain a diversified portfolio, and avoid panic selling. Seeking professional financial advice is advisable.

Summary: Today's market crash highlights the need for informed decision-making and careful risk management. Staying abreast of market developments and seeking professional advice are crucial in navigating such volatile periods.

Subheading: Tips for Navigating Market Volatility

Introduction: Market volatility presents challenges but also opportunities. This section offers strategies for navigating such periods effectively.

Tips:

- Diversify your portfolio: Spread your investments across different asset classes to reduce risk.

- Maintain a long-term perspective: Avoid making emotional investment decisions based on short-term market fluctuations.

- Stay informed: Keep abreast of market news and economic developments to make informed decisions.

- Consult a financial advisor: Seek professional advice to create a personalized investment strategy aligned with your risk tolerance and goals.

- Avoid panic selling: Emotional decisions driven by fear often lead to poor investment outcomes.

- Rebalance your portfolio periodically: Regularly rebalance your portfolio to maintain your desired asset allocation.

- Consider hedging strategies: Employ hedging techniques to mitigate potential losses during market downturns.

- Dollar-cost averaging: Invest regularly irrespective of market fluctuations to reduce the impact of volatility.

Summary: Market volatility is inevitable. By employing sound investment strategies, staying informed, and seeking professional advice, investors can mitigate risks and potentially capitalize on market fluctuations.

Summary of Today's Market Crash Analysis

Today's significant decline in the Sensex and Nifty indices reflects a convergence of global and domestic factors. Global market uncertainties, significant FPI outflows, persistent inflationary pressures, and the prospect of further interest rate hikes all played a crucial role in the market crash. Understanding these underlying causes is crucial for investors to make informed decisions and navigate this period of heightened market volatility.